Statute Of Limitations Colorado Debt

It’s called the debt statute of limitations. This usually is the date of the last payment you missed.

Statute Of Limitations On Private Student Loans State Guide - Credible

But don’t be mistaken—you aren’t off the hook for a debt just because the statute of limitations has passed.

Statute of limitations colorado debt. I agree to the terms of this garnishment payment reduction and by doing so, waive the statute of limitations for the collection of this debt. Statute of limitations on medical debt in colorado my question involves collection proceedings in the state of: The statute of limitations on debt by state.

Enforcement of instrument securing the payment of or evidencing any debt; When it comes to debt, the statute of limitations is the amount of time a creditor can take before asking the court to force you to pay for a debt. If the statute for your particular debt has passed, you should be clear that the debt is still owed even if the creditor has no legal recourse.

Put in other words, if a lawsuit asserting relief for an underlying action is not brought within the statute of limitations time period, the plaintiff will be barred from bringing the lawsuit indefinitely. Action to recover the possession of secured personal property; The colorado statute of limitation to sue for credit cards, deficiency balances, or loans of any kind, is 6 years.

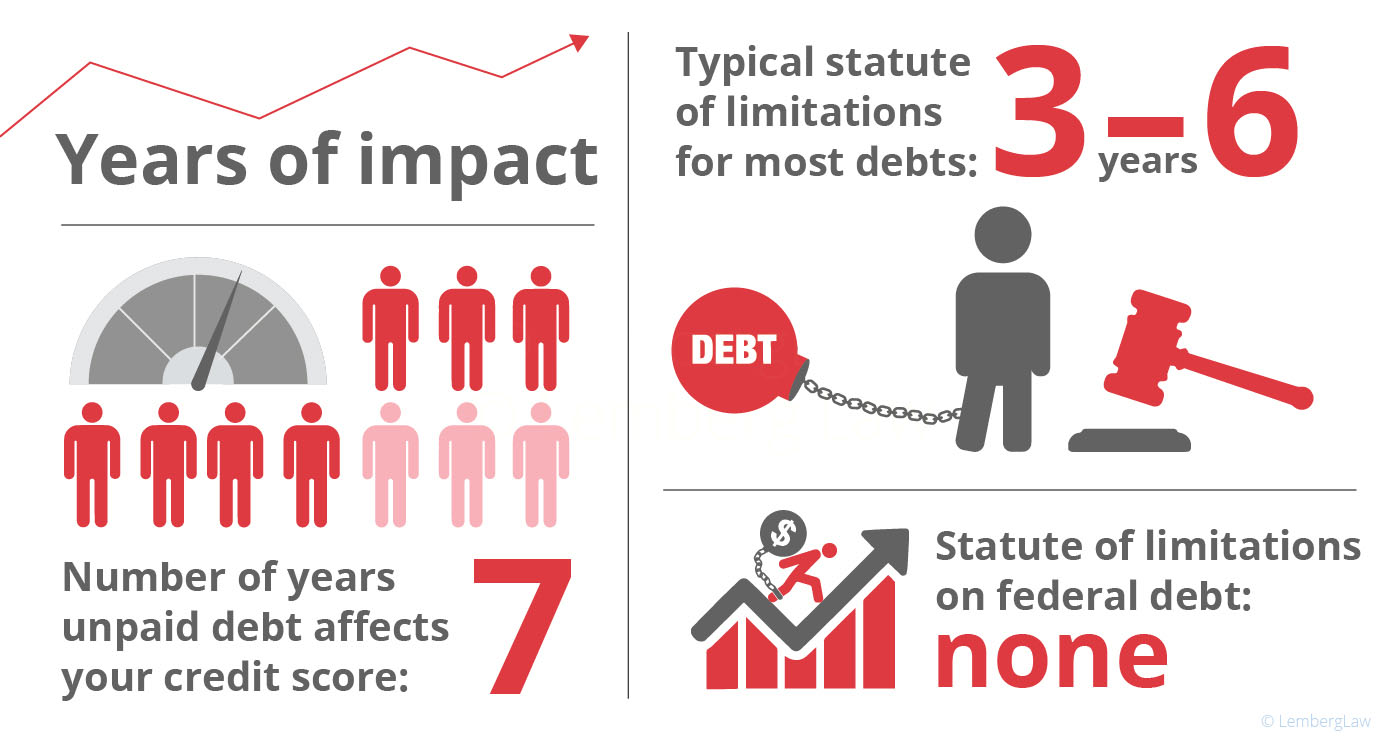

The length of time varies from state to state but ranges from 2 to 10 years. The statute of limitations is the time within which a debt collector can sue you for unpaid debts. Statutes of limitations for civil claims in colorado.

The statute of limitations in colorado depends on the type of debt which is being considered. The debt might still show up on your credit report, and if you don’t pay it, you could face trouble getting future credit, especially a mortgage. Conventional wisdom has been that collection actions had to be brought by lenders within six years from the date the loan first went into default.

Another misnomer regarding statutes of limitation that exists is that once this date has passed, the medical debt can no longer appear on your credit report. Colorado this is a strange one. Creditors and collection agencies can not sue.

After this period expires, the court can no longer order you to repay your old debt, and in most cases, it doesn’t make sense to do so. Once the statute of limitations has passed, the. Each state places limits on how long creditors can pursue debt.

In colorado, debt collectors can sue you for an unpaid debt for up to six years after you default on it. In colorado, the general breach of contract statute of limitation, whether the contract is oral or written, is three years. There are few exemptions for account levy in colorado.

The court system doesn't keep track of the statute on your debt. Liquidated debt and unliquidated determinable amount of money due; My wife and i were in a car accident in 2007, and we both had to be transported to the hospital.

Debt collectors have a limited amount of time to file a lawsuit. Unlike many states that set a variable time limit depending on the type of debt, the statute of limitations in colorado is six years for all debts. How long any item appears on your credit report has nothing whatsoever to do with the.

All consumer debts have limits on the number of years creditors have, and each state has its own limitations. Colorado debt statute of limitations. While each state is different, many states provide extra time to collect on debt that involves a written contract or a promissory note.

Being sued by creditors is a mere symptom of a larger problem, it is best to be proactive to cure the underlying cancer (debt) as opposed to treating the symptom which is the lawsuit. The statute of limitations is the period in which a creditor or debt collector can take legal action to recover a debt. Don’t expect to be sued right way.

(1) the following actions shall be commenced within six years after the cause of action accrues and not thereafter: Again, statutes of limitations on debt do hinge on what state you live in. Statutes of limitations are laws that require a cause of action to be brought within a certain amount of time after it accrues otherwise the action can no longer be brought.

The clock starts on the day you default. Most debts in colorado have a statute of limitations of six years. In colorado, most types of debt have a.

22 rows an colorado law on statute of limitations is simply that time which is allotted by the law as. Debts that have passed the statute of limitations are known as time. For open accounts such as credit cards, the statute of limitations is six years from the date on which it.

A statute of limitations is the amount of time a person can take in order to take legal action on a certain event. The statute of limitation ranges from two to 15 years depending on the state and the type of debt. Statutes of limitations are laws that govern the deadlines on certain legal actions.

The statute of limitations for most colorado debts is 6 years. Generally speaking, the more serious the colorado criminal case, the longer prosecutors have to file charges.and the most serious cases have no time limit at all. Taxpayer signature date sign and mail to:

What is the statute of limitations for lenders to pursue borrowers in colorado who default on a home loan? The statute of limitations on debt is a rule limiting how long a creditor can sue an individual for payment on a debt. Statute of limitations on debt by state 2021.

For any colorado statute of limitations questions. This chart shows the statute of limitations for each of the 50 states and the district of columbia. This is because colorado’s statute of limitations on debt is six years.

A statute of limitations is the time window the district attorney has to bring charges against a suspect. An experienced bankruptcy lawyer can look into your case to determine whether the statute of limitations for the debt has “run out”, or whether bankruptcy is the right path for you. The statute of limitations on a colorado home loan default probably isn’t what you think.

Oral debts are generally given the least amount of time for collection. This entry was posted on monday.

Statute Of Limitations In Colorado For Injury Claims Donaldson Law Llc

Colorado Domestic Violence Laws Statute Of Limitations

Statute Of Limitations For Contract Debts

Colorado Co Statute Of Limitations What You Should Know

What Is The Statute Of Limitations For Medical Debt - Nfcc

Personal Injury Lawsuit Time Limits The Statute Of Limitations In Georgia

Statute Of Limitations 2021 For Credit Card Debt Ask Carolyn Warren

How Long Do Collections Stay On Your Credit Report

Colorado Statute Of Limitations On Debt

The Statute Of Limitations On Debt Everything You Need To Know

Understanding The Statute Of Limitations On Debt Collection Mmi

Know Your Rights In Dealing With Debt Collectors The Denver Post

What Is The Statute Of Limitations On Collecting A Debt In Colorado

Colorado Debt Statute Of Limitations Robinson Henry Pc

How Long Do Collections Stay On Your Credit Report

Understanding The Statute Of Limitations On Debt Collection Mmi

Colorado Debt Statute Of Limitations Robinson Henry Pc

Can The Student Loan Statute Of Limitations Get Rid Of My Private Loans Student Loan Hero

Colorado Statute Of Limitations - Recording Law