Quitclaim Deed Colorado Taxes

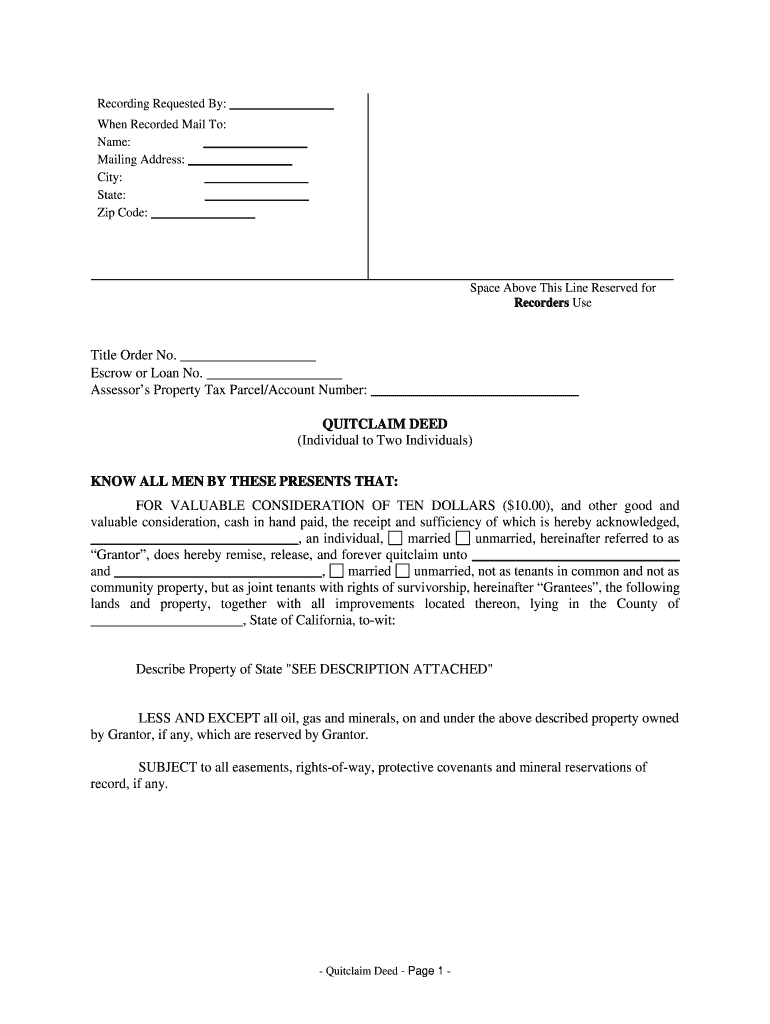

However, whereas other deeds shall provide a sort of insurance the the property is in no way encumbered or restricted, this type of deed provides no promises from the grantor that they would defend the grantee, in the event of an unexpected. Interspousal transfers versus quit claim.

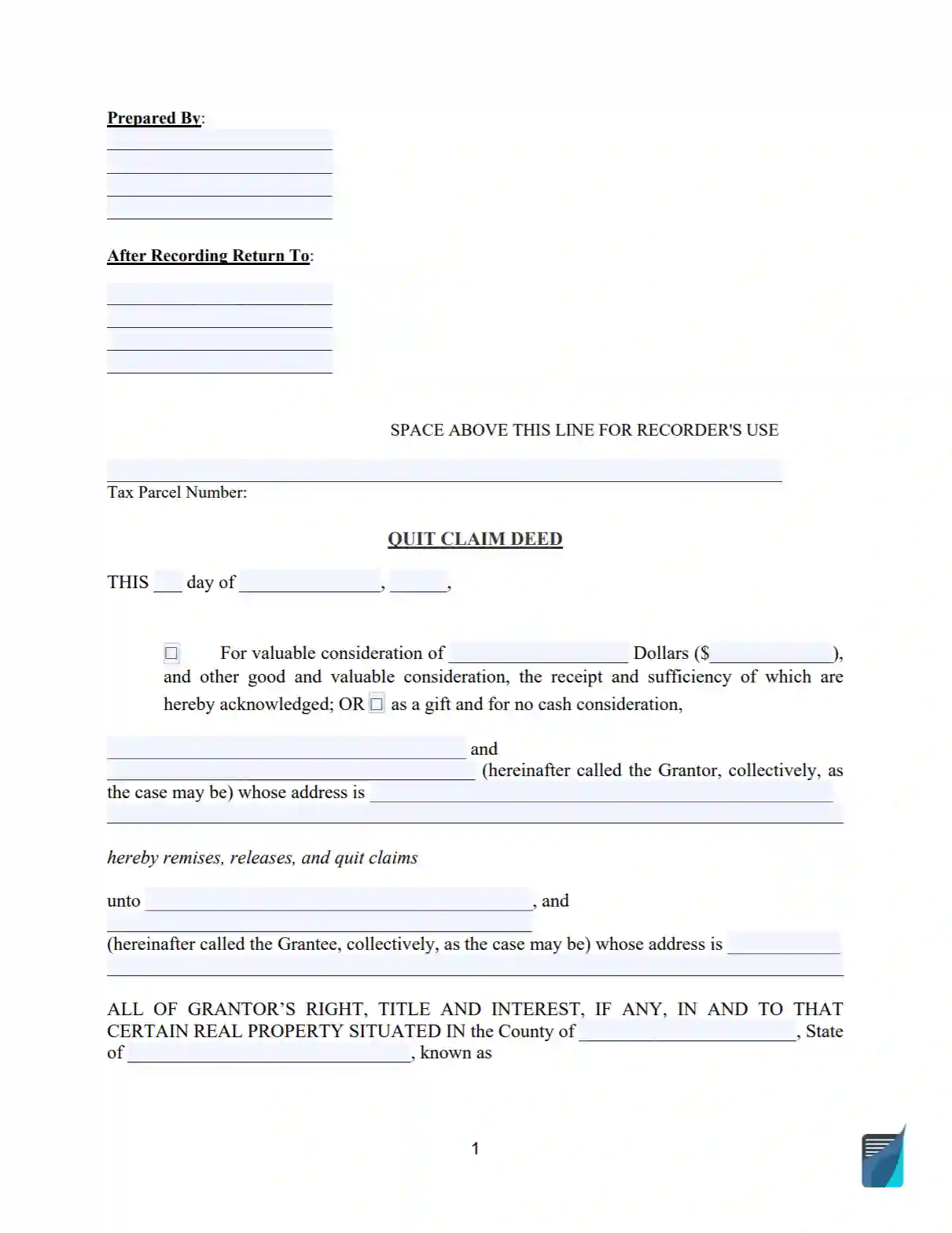

Free Quit Claim Deed Form Printable Pdf Template

Ad access any form you need.

Quitclaim deed colorado taxes. Complete, edit or print your forms instantly. Start 30 days free trial! If the grantor owes taxes from the period during which they legally owned the property, those taxes must be paid prior to the transaction.

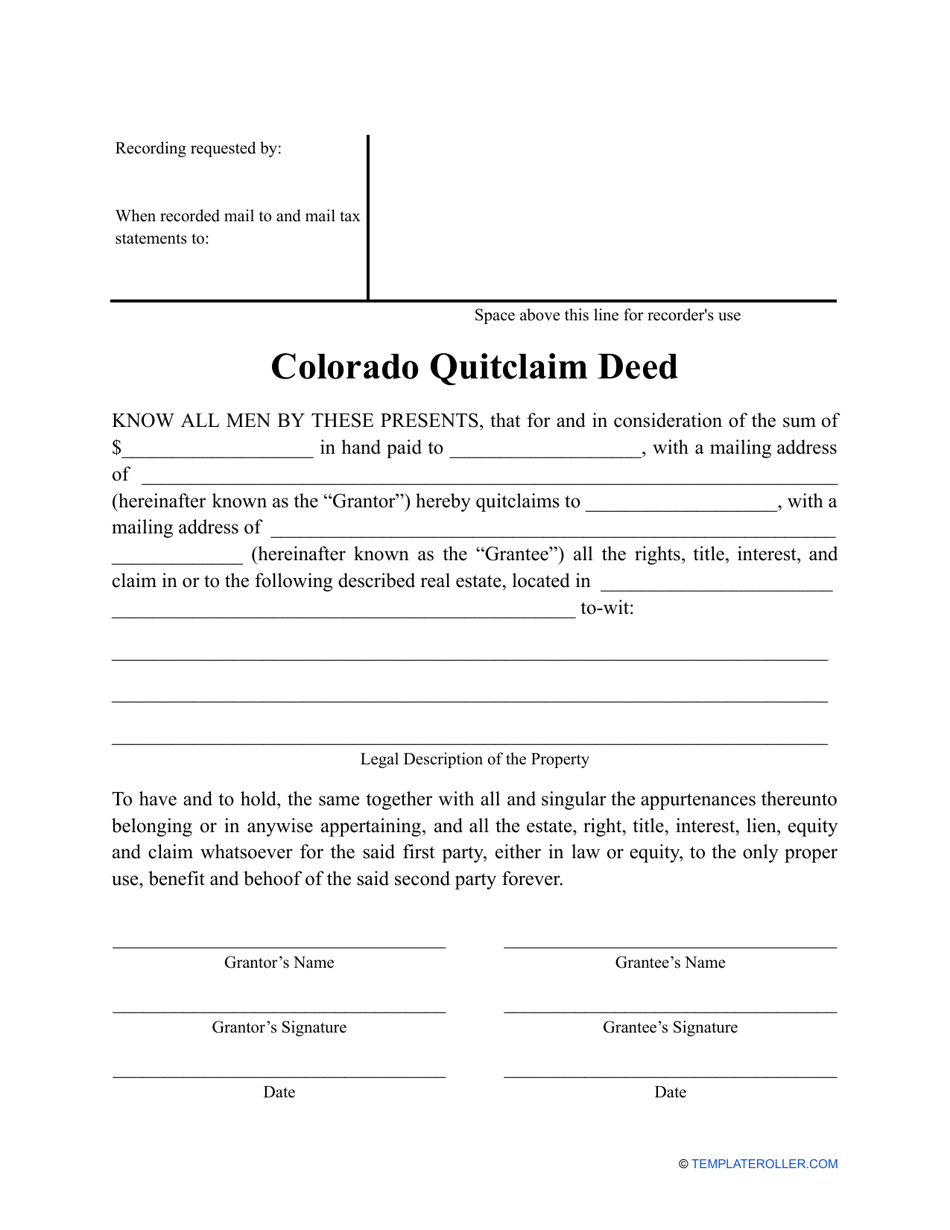

Ad save time editing pdf documents online. The owner is literally “quitting” his or her claim to the property, and transferring it to the grantee. Additionally, if there are tax liens on the property for other reasons, they too must be paid before the title can transfer.

Ad access any form you need. Deeds and transfer of title ; In the deed form, you will write your name as the grantor and the name of the property recipient ( the grantee).

When do you need to get a quitclaim deed?' accessed aug. However, a gift of more than $12,000.00 should be reported on a gift tax return. In colorado, a quit claim deed is a legal document used to transfer property from an owner to a seller in an expeditious fashion.

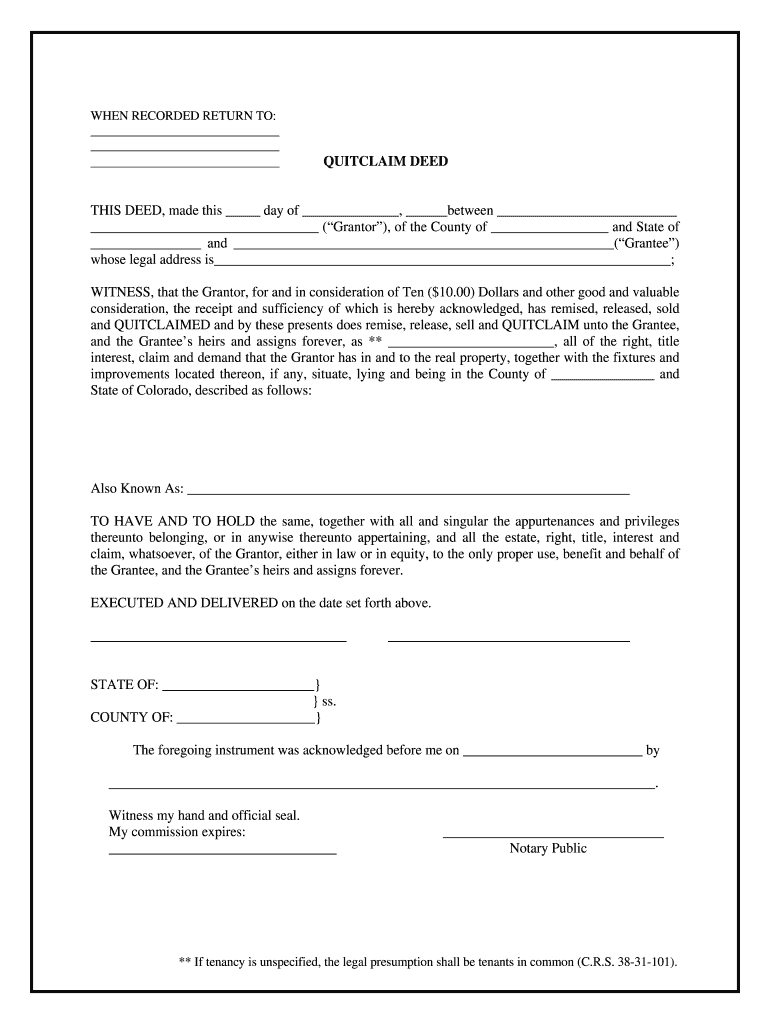

Tax code, gift taxes are paid by the giver, so the brother would have to fill out a gift tax form 709 , and he can apply the value of half the house to the lifetime maximum of $5.5 million he can give away under current estate tax rules. _____ quitclaim deed this deed, made this _____ day of _____, _____between _____ _____ (“grantor”), of the county of _____ and state of _____ and _____(“grantee”) Quitclaim deeds do not rid the grantor of tax obligations.

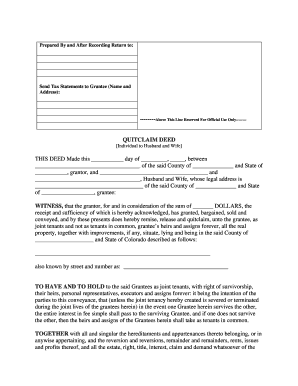

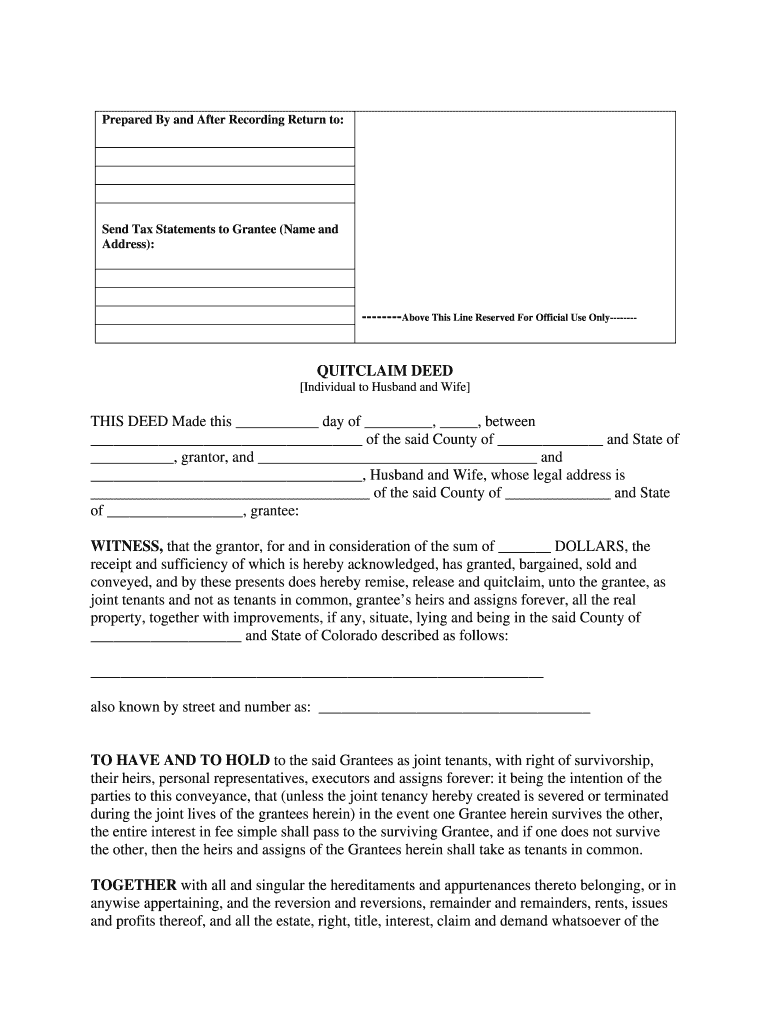

A colorado bargain and sale deed form is similar to a colorado quitclaim deed in that a bargain and sale deed also transfers real estate with no warranty of title. The disadvantages of a quitclaim deed in colorado. With a quitclaim deed, you can easily release the property and waive the rights to operate it.

There is no warranty whatsoever with a quitclaim deed. Start 30 days free trial! Under the terms of the u.s.

A colorado quitclaim deed form transfers whatever interest a property owner currently holds in real estate with no warranty of title. If the transferor of a quitclaim deed in a home sale lived in the home as a primary residence at least two years of the past five, capital gains of up to $250,000 ($500,000 if the quitclaim is conveyed by a couple filing jointly) are excludable from tax. Upload, edit & sign pdf forms online.

The colorado quit claim deed is a legal document that is used when a grantor (seller) is selling a parcel of land to a grantee (buyer). In most cases, that gift does not trigger any transfer tax. The transfer is considered a gift to the other joint tenant.

Quitclaim deeds also are not taxed when they transfer property to qualifying charities. 1 a warranty of title is a real estate owner’s enforceable promise that the owner holds clear title to the transferred real estate free of defects like liens, boundary disputes, and adverse claims. Contracts 101—warranty vs quitclaim deeds. accessed aug.

One key thing to do is waive rights to the property and demonstrate that you no longer claim it, and you can do this using the colorado quitclaim deed form. For income tax purposes, you cannot deduct the value of a gift from income tax unless the gift is to a. Complete, edit or print your forms instantly.

Upload, edit & sign pdf forms online. As to the tax question, the irs will view the addition of the letter writer via quitclaim deed as a gift. Ad a tax advisor will answer you now!

This type of transfer comes with no warranty, meaning it comes with no guarantees that the title is free and clear of any encumbrances or back taxes. Ad save time editing pdf documents online. The excluded amount is taken off the taxpayer’s total allowable lifetime exclusion.

The problems with using a colorado quitclaim deed as a transfer on death deed are numerous. 10 under colorado law, the difference between the two is that a bargain and sale deed passes any interest in the real estate the current owner acquires after the deed is signed.

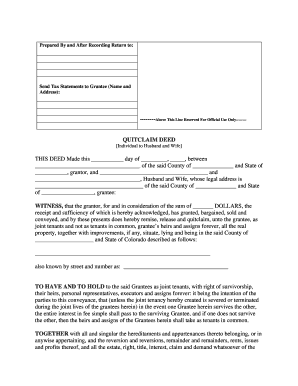

Quit Form - Free Printable Documents Quitclaim Deed Quites Cool Lettering

Should I Sign A Quitclaim Deed During Or After Divorce

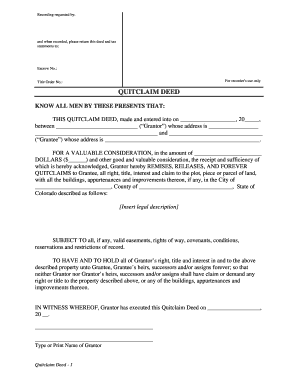

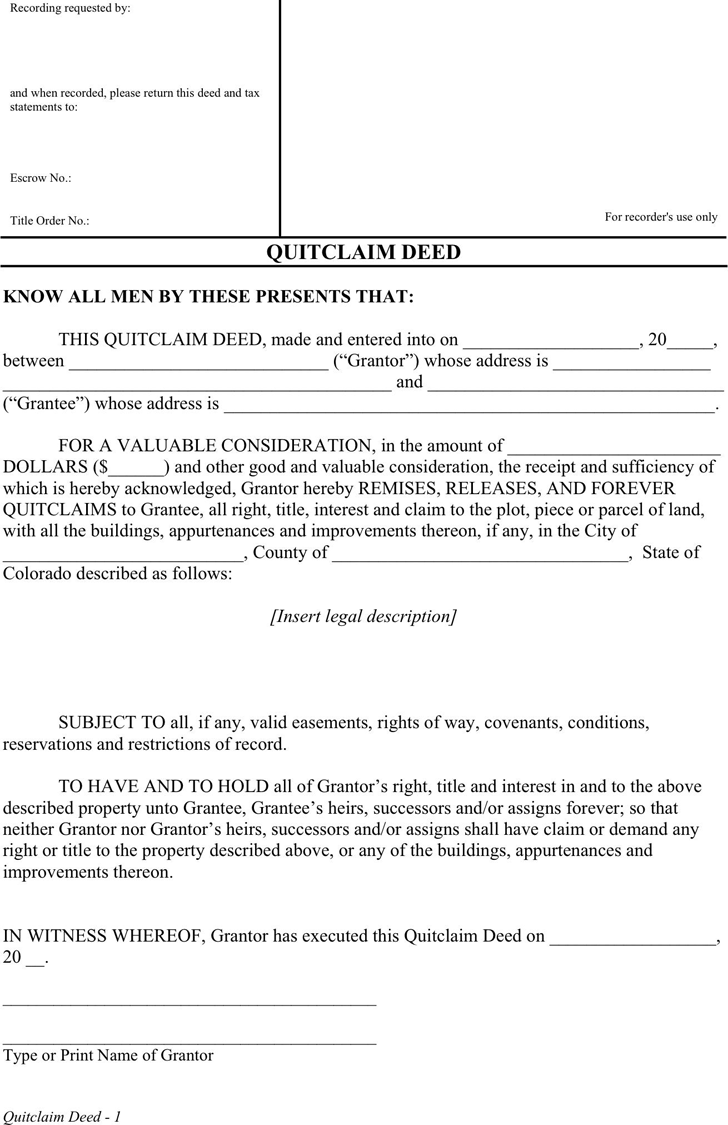

Quitclaim Deed Download Your Free Quitclaim Deed Form Pdf Word

Colorado Quit Claim Deed - Fill Out And Sign Printable Pdf Template Signnow

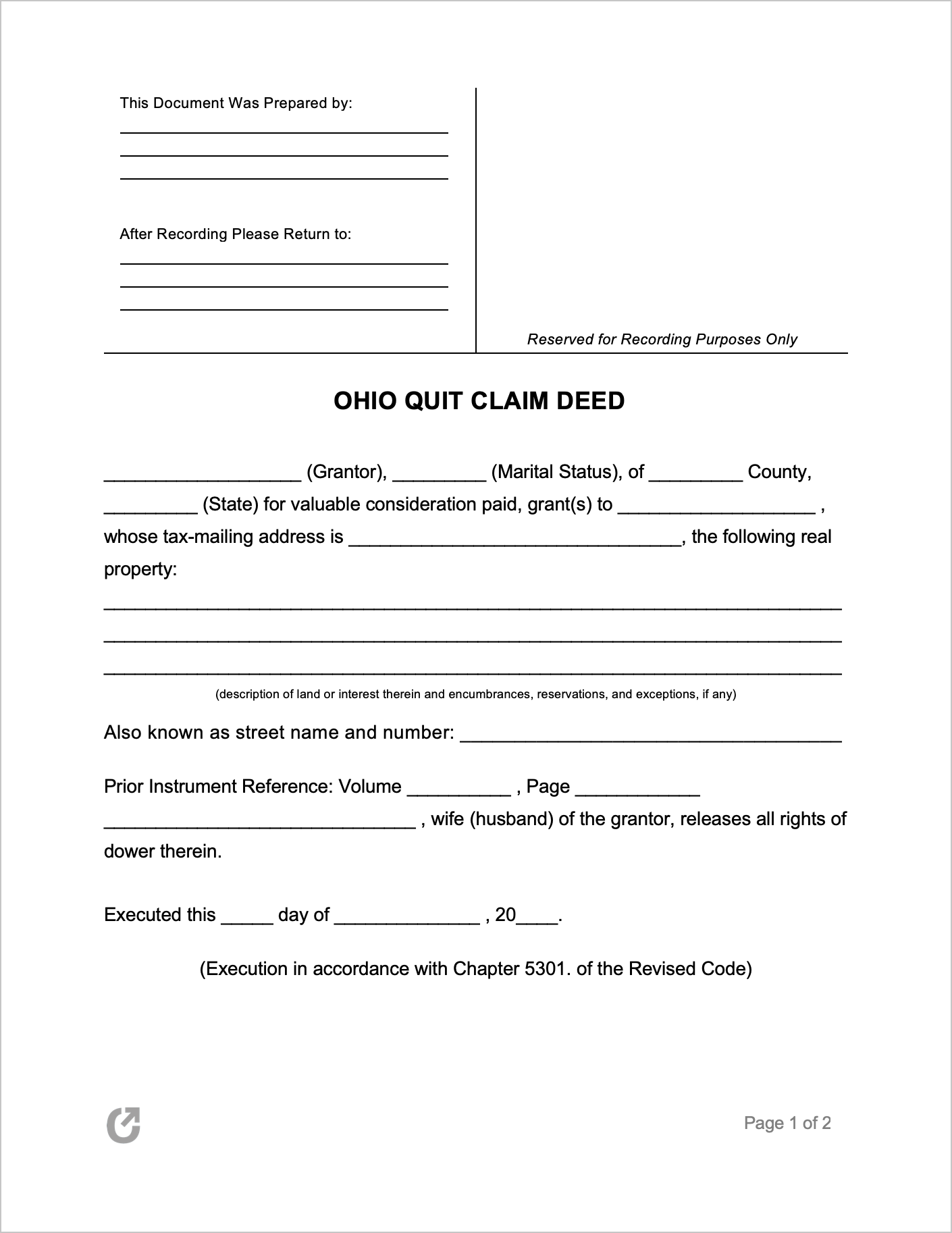

Free Ohio Quit Claim Deed Form Pdf Word

Joint Tenancy Quit Claim Deed Form - Fill Online Printable Fillable Blank Pdffiller

Quitclaim Deed Colorado - Fill Out And Sign Printable Pdf Template Signnow

Colorado Quitclaim Deed Form 2 - Pdfsimpli

Free 10 Sample Quitclaim Deed Forms In Pdf Ms Word

Co Quitclaim Deed Form - Complete Legal Document Online Us Legal Forms

Colorado Quitclaim Deed Form Download Printable Pdf Templateroller

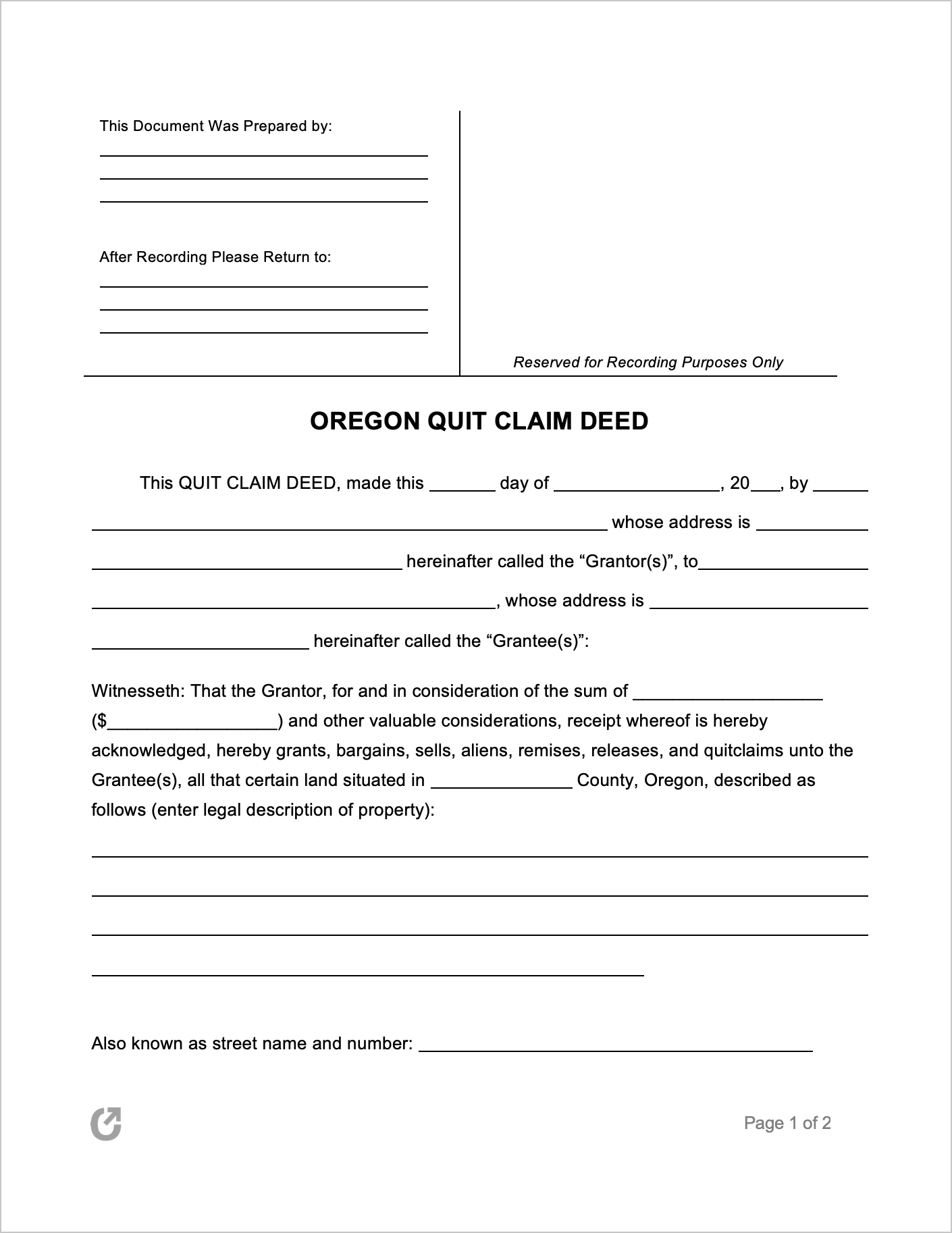

Free Oregon Quit Claim Deed Form Pdf Word

Quitclaim Deed - Fill Online Printable Fillable Blank Pdffiller

How Many Acres In A Quarter Section Of Land Us Dollars Golden Gate Bridge Holiday Insurance

Free New Mexico Quitclaim Deed Form How To Write Guide

Co Quitclaim Deed - Fill Online Printable Fillable Blank Pdffiller

Free Colorado Quitclaim Deed Form - Pdf 38kb 4 Pages

Quitclaim Deed - Information Guide Examples And Forms - Deedscom

Free Colorado Quitclaim Deed Form How To Write Guide