Colorado Paycheck Calculator Suburban

Calculate take home amount from your paycheck, view federal taxes and state payroll withholdings, including sdi and sui payroll state taxes. All amounts are annual unless otherwise noted

Kotler And Keller Marketing Management 1 268-296 Pdf Pdf Market Segmentation Shaving

(1) $0.00 if zero exemptions claimed.

Colorado paycheck calculator suburban. 2022 proposed military pay raise a. This page is designed to provide computer and payroll professionals with the current payroll withholding tables for all 50 states. We have designed this free tool to let you compare your paycheck withholding between 2 dates.

Use this calculator to help you determine your paycheck for hourly wages. How to calculate annual income. Figure out your filing status.

Subtract any deductions and payroll taxes from the gross pay to get net pay. South carolina withholding effective january 1, 2020. South suburban welding & fabricating co in posen, il received a paycheck protection loan of $59,772 through u.s.

To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. (2) 10% up to $4,200.00 if claiming 1 or more exemptions. We appreciate your interest in our inventory, and apologize we do not have model details displaying on the website at this time.

No personal information is collected. So the fiscal year 2021 will start from july 01 2020 to june 30 2021. Computes federal and state tax withholding for paychecks flexible, hourly, monthly or annual pay rates, bonus or other earning items

As the employer, you must also match your employees’ contributions. The maximum an employee will pay in 2021 is $8,853.60. This tool has been available since 2006 and is visited by over 12,000 unique visitors daily, and has been utilized for numerous purposes:

All amounts are annual unless otherwise noted. Payroll taxes change all of the time. The free online payroll calculator is a simple, flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Use before 2020 if you are not sure. Then enter the hours you expect to work, and how much you are paid. Bank, national association, which was approved in march, 2021.

This number is the gross pay per pay period. The exact status of ongoing loans is not released by the sba. State payroll withholding rates and tables.

Use these free 2021 paycheck calculators to calculate your net income and payroll taxes in your state. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information. Withhold 6.2% of each employee’s taxable wages until they earn gross pay of $142,800 in a given calendar year.

The average salary for suburban employees is $59,764 per year. First, enter your current payroll information and deductions. This calculator has been updated to use the new withholding schedules for 2012.

Employee information (optional) employer name. You can enter regular, overtime and one additional hourly rate. This loan has been disbursed by the lender and has not yet been fully repaid or forgiven.

For example, if an employee earns $1,500 per week, the individual’s annual income would be 1,500 x 52 = $78,000. Check out the 2021 us military pay scale charts for all ranks for active duty, as well as reserve and guard components. Under fica, you also need to withhold 1.45% of each employee’s taxable.

This wisconsin hourly paycheck calculator is perfect for those who are paid on an hourly basis. Lease calculator | see your leasing payments | tom gill chevrolet. Visit payscale to research suburban salaries, bonuses, reviews, benefits, and more!

Calculating your florida state income tax is similar to the steps we listed on our federal paycheck calculator: This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. It is not intended to provide tax or accounting advice.

A 2020 (or later) w4 is required for all new employees. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information. W4 (employee withholding certificate) the irs has changed the withholding rules effective january 2020.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Paycheck manager's free payroll calculator offers online payroll tax deduction calculation, federal income tax withheld, pay stubs, and more.

2021 Chevrolet Suburban Lease Near Wheaton Il

Colorado Paycheck Calculator - Smartasset

Email Konfirmasi Himatika Fst Uin Jakarta

The City Vs The Suburbs Well Help You Decide Real Estate News Insights Realtorcom

2021 Best California Counties To Live In - Niche

Logo-himatikapng Himatika Fst Uin Jakarta

Exjs7lzwaufkpm

2

2

Happiness And Place Cities V Nature Why Life Is Better Outside Of The City Pdf Quality Of Life Happiness

Paycheck Calculator Easily Calculate Take-home Pay - Viventium

The City Vs The Suburbs Well Help You Decide Real Estate News Insights Realtorcom

Eric Ed469737 Pdf English As A Second Or Foreign Language Multilingualism

Wisconsin Property Tax Calculator - Smartasset

Pdf Environmental Protection Population Change And Economic Development In The Rural Western United States

Why Households Need 300000 To Live A Middle Class Lifestyle

Colorado Salary Paycheck Calculator Paycheckcity

Work From Home - Realtorcom Economic Research

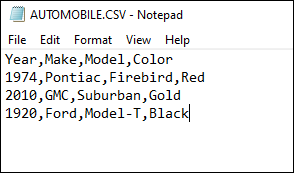

Importing Csv Files Into Payroll System - Cfs Tax Software Inc